Personal

Credit Repair

Help yourself to a better financial future

What is credit repair?

Credit repair is when you improve a bad credit score by disputing and removing errors on your credit report. Your credit score is your Financial DNA; it determines your cost of living, your credit availability, and your money opportunities. Therefore repairing your credit score is a must.

Although the Fair Credit Reporting Act gives the right for accurate credit reports, errors and negative entries still feature on your credit report, and a bad credit repair is often needed to restore your credit score.

Why choose a credit repair company over DIY repairs

The leading CRA’s offer free access to your credit report annually and provide some useful tools to help you repair your credit yourself (link to diy tips). If you are looking to repair your credit for a specific reason, these free tools may prove successful.

However, if you are looking to establish reliable and sustainable creditworthiness, working with a credit repair specialist ensures your credit repair with professional skills and experience that you may not have.

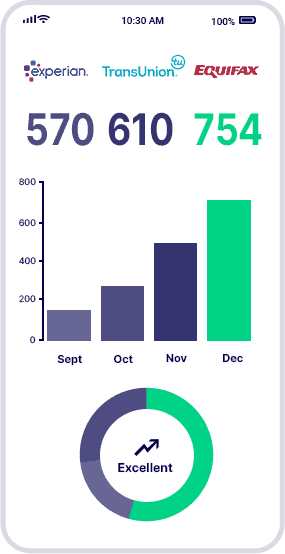

Furthermore, expert credit repair services will get you better results, faster. An expert credit repair agency will also help you to improve your score across all CRA’s and relevant scorecards.

Just attempting to repair one of your credit reports won’t get you very far because a negative entry that is filed with one CRA won’t necessarily appear on your other credit reports. Why get overwhelmed with credit repair? Hand this over to the experts for just a small fee and gain peace of mind.

How we help to fix your credit score

1. Credit report analysis

We analyze your credit reports from all three bureaus and make a plan for all the questionable negative items that may be lowering your credit score. This ensures your credit reports are fair and accurate.

2. Dispatch Credit Disputes

Our expert credit repair team will challenge all the negative entries on your behalf. We will ask your creditors to verify the negative item they are reporting. If they can’t, the law requires them to stop, and we will dispute their past reports with the CRA’s to get them removed and fix your bad credit.

3. Monitor the progress of disputes

We will make sure that all inaccuracies are removed even if it requires ongoing correspondence. We will keep monitoring the disputes until your rights are fairly represented, and your bad credit is fixed.

4. Continuous credit support

We are always available to provide you with expert credit repair help and 24/7 access to your credit report analysis. At the same time, we will provide you with personalized tips to establish reliable and sustainable creditworthiness.

How long does it take to repair my credit?

Everyone wants a fast credit repair because it’s a ticket to a better financial future. However, the length of time it takes to repair your credit can’t be guaranteed because every credit report is unique. The good news is that getting negative and inaccurate information removed from your credit reports is one of the fastest ways to fix your credit score. This is because credit bureaus have to respond and resolve a dispute within 30 days (and at times a maximum of 45 days).

Many people wonder how they can fix their credit score in 6 months. We help thousands of people each year fix their bad credit fast, and typically they’ve stayed with us for six months for a job well done. With our team of credit repair experts and our premium credit monitoring software, our bad credit removal process is streamlined to get you the best results in no time at all.

Dispute Resolution

30 to 45 days

Average

Amazing Credit Score

2 to 6 Months

Maximum

How does credit repair work?

We have already explained how credit repair works from our side of things; now, we will explain the consumer’s input.

- Log into your account and gain full access to your credit reports from all three bureaus.

- Watch how we improve all your credit reports at once whilst receiving constant updates of the changes we make.

- See your credit score increase, and become something to be proud of.

- Get personalized recommendations that you can follow daily to establish sustainable creditworthiness.

Pricing

$69 per month

- Sign up for a no obligation free trial

- It takes less than two minutes to get started

- Using Renoix will not impact credit score

- Cancel at anytime

How much does credit repair cost?

We have one price and one unbeatable service. We charge only $69 a month. A price that you will not find elsewhere. We offer a 90-day money-back guarantee so you can join risk-free. So go ahead and experience the credit repair service you deserve with the Renoix difference.

Pricing

How much does credit repair cost?

We offer a 30-day money-back guarantee so you can join risk-free. So go ahead and experience the credit repair service you deserve with the Renoix difference.

Credit Repair Package $89

- Credit Monitoring

- Identity theft protection

Credit Building Package $149

- Credit Monitoring Package

- + Credit Building strategy

Credit Dispute Package $229

- Credit Monitoring Package

- Credit Building Package

- + Credit disputing

- + Credit freezing

Why credit monitoring services are so important

A progressive credit monitoring service looks at your continuous financial habits and helps you defeat issues before they even get passed on to the credit bureaus. Once a financial mistake is reported to the CRA’s, it becomes part of your history which no one can change.

We will also provide you with ongoing credit rebuilding guidance and show you untapped opportunities in your credit profile. Our expert assistance team will translate these opportunities into practical advice that you can use today to raise your credit score.

Common Questions

How will I benefit from a credit clean up?

With the prolonged pandemic, the world is entering a recession that is expected to intensify by 2021 / 22. Credit is going to become less accessible and far more expensive. Only people with a good credit score will be able to access credit at reasonable rates. Therefore cleaning up your credit reports has become more essential than ever before if you need to borrow any form of credit.

How can I build my credit score fast?

Here are some of the best ways to rebuild your credit score fast:

Pay your bills on time

- Get credit for paying your utility and phone bills on the time.

- Pay off all debts and keep your balances low on revolving credit (credit cards).

- Dispute any errors on your credit reports or pay a credit repair agency to dispute and repair your credit on your behalf.

Remember: Building your credit score isn’t magic, it takes time and work, but the effort will pay off.

How can I build credit with bad credit?

There are 2 ways to build bad credit. Firstly you need to review all your credit reports and get any inaccuracies removed. Secondly, you have to change your financial behavior. At until they are removed. We also look at your ongoing financial money habits and provide you with personalized guidance so that you defeat mistakes before they even get passed on to the bureaus. This is a service you can’t beat!